Transporting goods between Great Britain and the EU by RoRo freight: guidance for hauliers

Guidance for haulage companies and commercial drivers moving accompanied (self-drive) RoRo freight and unaccompanied RoRo freight between Great Britain (England, Scotland and Wales) and the European Union.

Applies to England, Scotland and Wales

Section 1: Introduction and background

This guidance is for hauliers and commercial drivers who move goods or pick up/drop off trailers between Great Britain (England, Scotland and Wales) and the European Union (EU).

It explains:

- what documents you need

- how to follow new rules to manage traffic heading to ports

- new border control processes

Guidance on moving goods between Great Britain and Northern Ireland will be published separately.

Goods: Personal allowances

If you travel to Great Britain (GB) from outside the UK, there are new rules on goods you can bring in for your own use without paying tax or duty.

Find out about bringing personal goods into the UK and know if you need to declare them.

Rules for drivers and personal food and drink

Drivers travelling to and from the EU should know the rules about what personal food, drink and plants they can take with them. These rules apply to items carried on their person, in luggage or in the vehicle.

Taking food and drink into the EU

The highest risk plants and plant products, including some fruits, vegetables, flowers and seeds, require a phytosanitary certificate before being allowed into the EU.

Drivers cannot take meat or dairy products (for example, a ham and cheese sandwich or coffee with milk) into the EU.

If drivers have banned items with them, or they are not carrying the necessary certification, they will need to use, consume or dispose of these items at or before the EU border. Failure to do so may result in them being seized and destroyed. You may also be fined or face criminal prosecution.

Find out about taking meat and dairy products into the EU, Switzerland, Norway, Iceland or Liechtenstein.

Bringing food and drink into Great Britain

New rules for bringing animal and plant products from the EU into GB will be announced shortly and we will update the guidance then.

In the meantime, you must not bring over 2kg of pork or pork products from the EU into GB unless they meet EU commercial production standards. Failure to do so poses a risk of spreading African swine fever.

If you have banned items or do not carry the necessary certification, you will need to use, consume or dispose of the banned items at or before the GB border.

Failure to do so may result in the banned items being seized and destroyed, and you could face prosecution.

Find out about personal food, plant and animal product imports.

Securing a vehicle when travelling to and from the UK

UK, non-EU and EU haulage companies and their drivers must secure vehicles coming into the UK to reduce the risk of becoming a victim of crime.

Drivers crossing the UK-EU border should be aware of the potential threats to vehicles and loads and how they can help stop ‘clandestine entrants’. A clandestine entrant is a person who hides in or on a vehicle to avoid going through UK border control.

If a driver does not secure a vehicle, and is found carrying clandestine entrants into the UK and UK controlled zones, the vehicle’s driver, owner or hirer can each be fined up to £10,000 for each person found (also known as a ‘civil penalty’).

If you are driving a goods vehicle, and it is not adequately secured, you could also get a fine, even if no clandestine entrant is found. You may face a fine of up to £6,000 if you drive a goods vehicle that is not adequately secured. This applies whether you are entering or departing the UK.

A vehicle’s owner, hirer or driver can be fined. For detached trailers, a vehicle’s owner, hirer or operator can be fined. Companies may be liable for fines imposed on their drivers.

The law applies to all arrivals into the UK or UK control zones, including from European ports and via the Eurotunnel.

Keeping vehicles secure

For haulage companies, an effective system includes:

- written instructions for drivers on how to use the system

- robust security devices to effectively secure the vehicle, load and load space

- evidence of training for drivers on how to use the system and security devices providing vehicle security checklists to drivers

For drivers, an effective system includes:

- application of security devices (for example, a padlock, uniquely numbered seals and tilt cord) to secure vehicles after loading

- checking the security devices and vehicle thoroughly after each stop and before entering the UK

- recording comprehensive checks on a vehicle security checklist, to show compliance, and have available to present to a Border Force officer

Drivers should follow the guidance on preventing clandestine entrants, and carry this with them throughout their journey.

If someone hides in a vehicle

If a driver suspects someone is attempting to enter their vehicle or has entered their vehicle, they should contact local police as soon as it is safe to do so. In the UK call 999 or in the EU call 112 before you enter the port.

Inland border facilities

Inland border facilities (IBFs) are UK government sites where customs and documentary checks can take place away from port locations.

IBFs act as an Office of Departure (for outbound journeys) and as Office of Destination (for inbound journeys).

Checks for the following movements are carried out at IBFs:

- Common Transit Convention (CTC), also known as Transit

- ATA Carnet

- Transports Internationaux Routiers (TIR) Carnet

- Convention on International Trade in Endangered Species of Wild Fauna and Flora (CITES)

- other forms, for example, C108, duplicate lists, etc – check with your trader what you need to carry

An IBF app is available for smartphones on the Google play store and the App store.

Note: Not all hauliers will need to attend an IBF unless required to undertake an Office of Transit check. For example, if you are starting or ending a CTC movement at the premises of an Authorised Consignor or Authorised Consignee and already have a validated Transit Accompanying Document (TAD), you do not need to attend an IBF.

It is important to note that IBFs are not:

- truck stops/rest points for drivers – drivers should check the amount of driving time left on their tachographs when entering an IBF to minimise risk of having to find a place (elsewhere) for the mandatory rest breaks while also wanting to attend the IBF

- places to initiate customs formalities (go elsewhere for those services – there are no customs agents on site)

- mandatory for every export – if you already have all your paperwork for both sides and Permission to Progress (P2P) from CHIEF then you don’t need to attend an IBF

IBF locations and functions

| IBF site | Location | Functions |

|---|---|---|

|

Sevington inland border facility (inbound and outbound) |

Ashford TN25 6GE sat nav: 51.132138, 0.914994 what3words: corner.coach.sing |

Start transit movement (Office of Departure) End transit movement (Office of Destination) ATA carnets stamp CITES Traffic management |

| Dover Western Docks (inbound) |

Dover Western Docks Lord Warden Square Dover CT17 9DN |

End Transit movements (Office of Destination) ATA and TIR carnets stamp CITES licence check Physical checks and inspections |

| Stop 24 (inbound) |

Folkestone Services Junction 11 M20 Hythe CT21 4BL |

End transit movement (Office of Destination) ATA and TIR carnets stamp Physical checks and inspections |

|

Holyhead – Port of Holyhead (inbound and outbound) |

Holyhead Port | Office of Transit CITES checks |

|

Holyhead – Inland border facility (inbound and outbound) |

Parc Cybi A55 Junction 2 Holyhead LL65 2YQ |

Start transit movement (Office of Departure) End transit movement (Office of Destination) ATA and TIR carnets stamp Process CITES permits Receive physical checks and inspections Transporting live animals If you’re transporting animals under an ATA Carnet, tell Border Force the time you are expected to arrive, so they can prioritise processing your ATA Carnet. When your crossing is confirmed, tell Border Force the time you are expected to arrive at Holyhead inland border facility service at least 24 hours before your arrival. If you’re a UK trader transporting live animals, lodge a travel plan with DEFRA before you start your journey. Notify Border Force of your arrival by emailing BFHolyhead@HomeOffice.gov.uk Get ready before you travel to Holyhead – use an authorised consignor/consignee to start or end your transit movement |

Traffic management at other ports

The Short Straits routes via Kent are particularly vulnerable to disruption, and this area is the focus of most traffic management plans. Highway Authorities with high-volume ports may also have localised traffic management schemes. During normal business, these will only be introduced if there is abnormal traffic disruption and hauliers should follow local traffic signs if these are implemented.

Empty trucks and trucks with reusable packaging

If you are carrying packaging, you will need to check with the importer and/or exporter:

- whether it meets the reusable packaging criteria

- whether you have the authority to make a declaration by conduct on their behalf on import

- whether the declaration is for the free circulation procedure or temporary admission

- check the rules in GB (and the EU) about swap body containers

- check the rules about machinery mounted on HGVs to facilitate loading and unloading

These items include plastic or metal cages, crates or frames.

At GB entry locations you can make a declaration by conduct for all reusable packaging. The declaration by conduct will generally be by disembarking from a vessel.

At EU entry locations, the haulier should check whether the packaging is EU or GB origin as this will impact which formalities you need to follow.

On export the declaration by conduct will be made by driving across the boundary of a port.

Find out about declaring reusable packaging for GB imports and exports.

Section 2: Driver and haulier requirements, licences and responsibilities

Drivers: documents, licences and permits

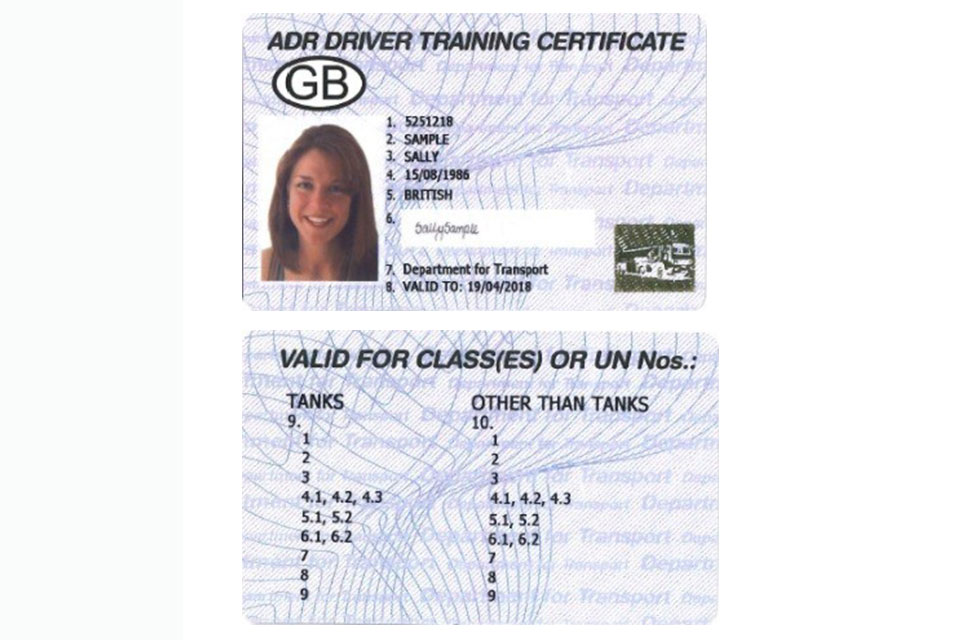

Driver Certificate of Professional Competence

All UK and EU drivers need a Driver Certificate of Professional Competence (CPC) in order to work. Drivers need to carry their Driver CPC qualification card while driving in the EU and UK.

Drivers working for UK operators

Drivers with a current UK Driver CPC working for UK operators do not need to take any additional action regarding qualifications. A UK Driver CPC is valid for drivers of all journeys that UK operators are entitled to undertake, either on the basis of the UK-EU Trade and Cooperation Agreement or on the basis of ECMT permits.

EU drivers can work for UK operators with a Driver CPC awarded by EU member states. If such drivers wish to have long-term certainty on their ability to work for UK operators, they should exchange their EU Driver CPC for a UK Driver CPC. To do this you’ll need to send your EU Driver CPC card to DVSA if you want to exchange it for a GB Driver CPC card or to the DVA if you live in Northern Ireland.

Find out about exchanging a EU Driver CPC for a UK Driver CPC.

Given the UK is a third country, UK nationals may need a ‘third country driver attestation’ in case they do not meet the conditions set out in Regulation 1072/2009 ‘on common rules for access to the international road haulage market’.

UK drivers working for EU operators

Drivers who hold a UK Driver CPC working or wanting to work for EU businesses should check with the relevant organisation in the country where they live and work to find out what they need to do.

Driving licences and international driving permits

Drivers need the correct category of driving licence for the vehicle they are driving. Drivers can check the driving categories on their licence.

You do not need an International Driving Permit (IDP) to drive in the EU, Switzerland, Norway, Iceland, or Liechtenstein if you have a photocard driving licence issued in the UK.

You might need an IDP to drive in some EU countries and Norway if you have either:

- a paper driving licence

- a licence issued in Gibraltar, Guernsey, Jersey or the Isle of Man

You can get an IDP in person from certain shops that have PayPoint.

An IDP costs £5.50.

Check if you need an international driving permit (IDP) first.

Visas, passports and identity cards

UK drivers need at least 6 months on a UK passport to travel to the EU. Drivers can check if they need to renew their passport.

UK drivers can operate in most EU member states without the need for a visa or a work permit, providing they do not spend more than 90 days in the EU within any 180-day period. However, visa and work permit arrangements for undertaking paid work in the EU is a matter for individual member states, and operators should check with the relevant authority of each country in which they plan to undertake work before travelling.

Information about how to get a visa, if you need one, is on each country’s travel advice page.

EU, European Economic Area (EEA) and Swiss national identity cards are not accepted as valid travel documents and a passport is required for entry to the UK. This does not apply to EU, EEA and Swiss citizens who applied to the EU Settlement Scheme by 30 June 2021 or otherwise have protected rights under the Citizens’ Rights Agreements.

Gibraltar identity cards issued to British citizens and Irish passport cards will also continue to be accepted for travel to the UK. Further details on the new requirements and exceptions will be provided on GOV.UK.

There may be delays when applying for a UK visa as a professional driver.

HGV road user levy

From 1 August 2023, for an HGV weighing 12,000 kg or more, the HGV road user levy must be paid before the vehicle is driven on UK roads.

For non-UK vehicles, the levy can be paid online.

For UK vehicles, the levy is paid alongside Vehicle Excise Duty.

It is an offence to drive an HGV without the correct levy, and anyone doing so is liable for a fine.

UK haulier requirements: documents, licences and permits

Access to the EU

UK operators can undertake unlimited journeys to, from and through the EU. Up to 2 additional movements (cross-trade or cabotage) may be undertaken within the EU following a laden journey from the UK, with a maximum of one cabotage movement within a 7-day period. It must be within the same EU country where you dropped off your goods brought into the EU.

Both additional movements may be cabotage movements in Ireland for Northern Ireland operators provided they follow a laden journey from Northern Ireland and are performed within a 7-day period.

Own-account operators (operators transporting their own goods) who are carrying goods for a commercial purpose are subject to these cabotage and cross-trade rules when operating in the EU.

Movements that do not count as cabotage/cross-trade:

- driving an empty trailer from one EU country to another

- only dropping off goods in the EU that you transported from the UK

- only picking up goods in EU countries, which can then only be dropped off in the UK, not another EU country

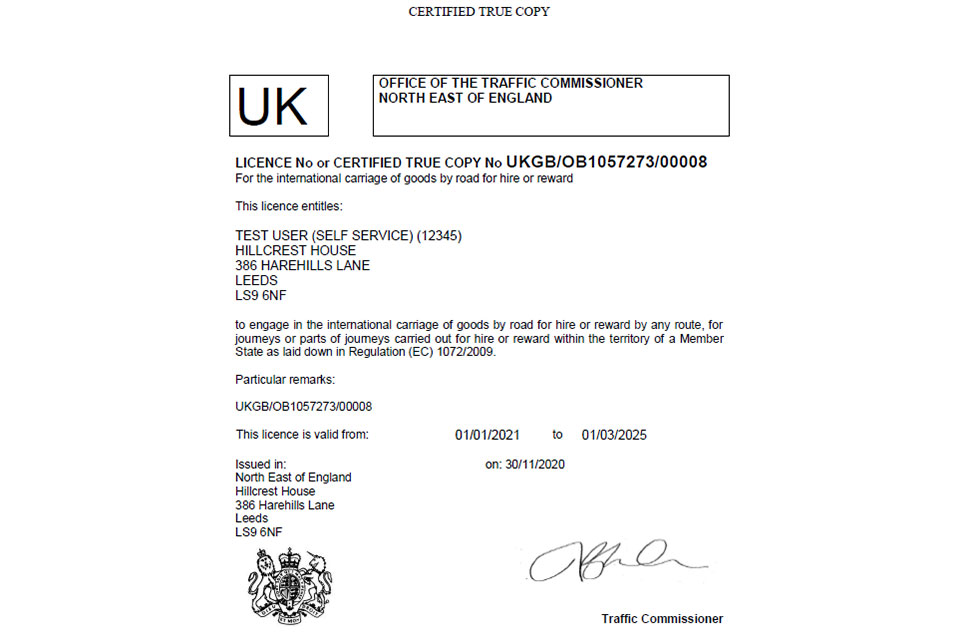

Operator licensing: UK Licence for the Community

UK hauliers undertaking international work need the relevant operator licence.

A copy of the UK Licence for the Community should, in all circumstances, be carried on board all vehicles when working in the EU.

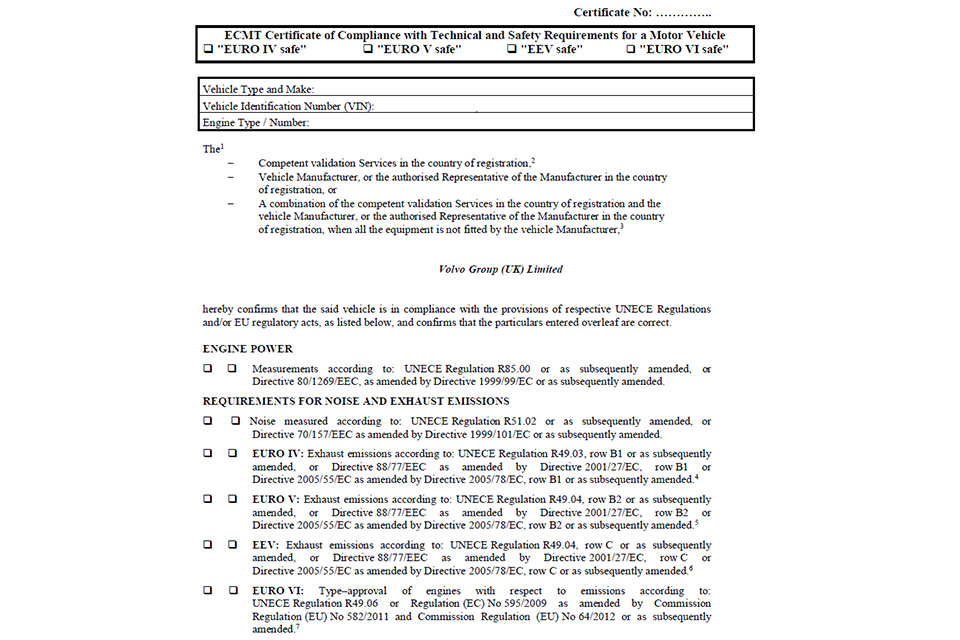

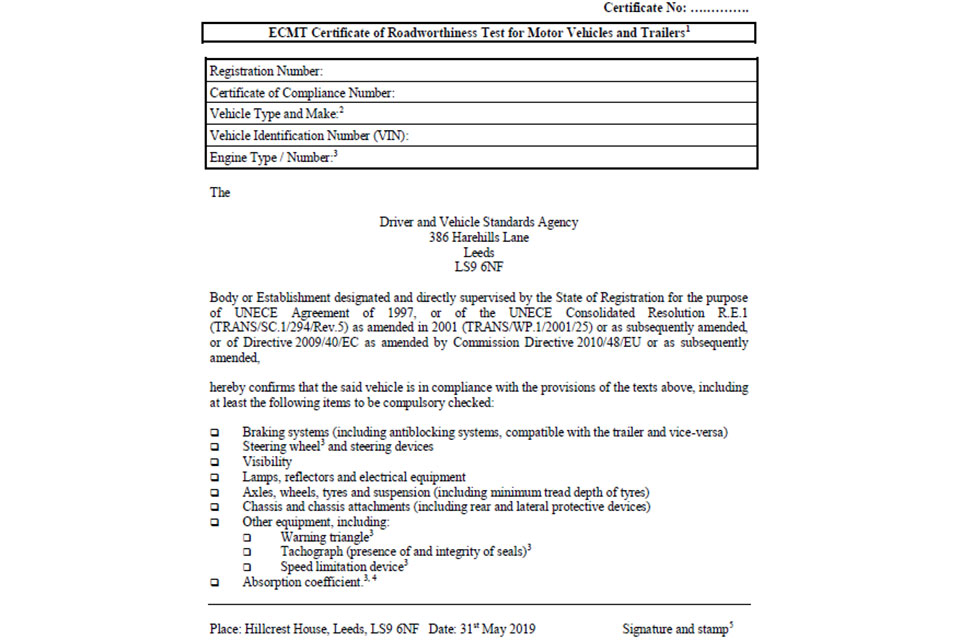

ECMT permits

UK hauliers who wish to undertake up to 3 cross-trade movements (moving goods between 2 countries outside the UK) may do so using a European Conference of Ministers of Transport (ECMT) permit.

Find out about the ECMT application process.

Motor insurance Green Card

A Green Card is proof of vehicle insurance when driving abroad. From 2 August 2021, UK drivers do not need to carry a Green Card when driving in the EU (including Ireland), Andorra, Bosnia and Herzegovina, Iceland, Liechtenstein, Norway, Serbia or Switzerland.

Vehicle registration documents

Drivers need to carry vehicle registration documents when driving abroad. This can be either:

- the vehicle log book (V5C), if you have one

- a VE103 to show you’re allowed to use a hired or leased vehicle abroad

UK or GB sticker

Vehicles registered in the UK must display the letters ‘UK’ when driven abroad (excluding Ireland).

UK identifiers can either be incorporated in vehicle number plates (along with the Union flag) or as a separate sticker.

GB stickers must be replaced by UK stickers.

Drivers do not need a UK sticker to drive in most countries (except Spain, Cyprus and Malta) if their number plate includes a UK identifier with the Union flag (the Union Jack).

Vehicles registered in Great Britain or Northern Ireland do not need to display a UK sticker to drive in Ireland.

Drivers must display a UK sticker clearly on the rear of vehicles and trailers if their number plate has any of the following:

- a European flag symbol

- a national flag of England, Scotland or Wales

- numbers and letters only – no flag or identifier

EU haulier requirements: documents, licences and permits

Access to the UK

EU operators can undertake unlimited journeys through the UK, from the EU or to the EU. Each journey can include up to 2 cabotage movements in the UK, provided these are performed following a laden journey from the EU, and within 7 days of unloading in the UK.

Community Licence

EU operators must be licensed by their own country of establishment and carry a true certified copy of the Community Licence at all times.

For journeys moving goods between the UK and other non-EU states, access to the UK is under the ECMT permit system, provided the journey is between states that are ECMT members.

Driver and vehicle documentation

EU operators doing business to, from or through the UK need to carry proof of motor insurance for their vehicle and trailer. A green card or other proof of motor insurance is recognised in the UK. However, green cards are not mandatory for EU drivers in the UK.

HGV road user levy

EU operators must pay the correct HGV road user levy for HGVs weighing 12,000kg or over before those vehicles drive on UK roads.

It is an offence to drive an HGV on UK roads without the correct levy. EU operators will be liable for a fine if their vehicle did so.

Cross-border responsibilities when moving goods

Trader

It is the trader’s responsibility to make customs declarations and provide the haulage company and driver with the correct documents. This can be done directly or via a third party, for example, a freight forwarder, logistics company or customs agent.

Haulage company

The haulage company must ensure their operations have access to IT systems such as Goods Vehicle Movement Service (GVMS) and GB safety and security (S&S GB) – this can be done by registration and will require the haulier to have a GB Economic Operator Registration and Identification (EORI) number.

The driver should have all the necessary customs information and documents and other paperwork for the route they intend to use. If the haulier intends to use a third party to complete the S&S GB entry, they will need to have put this in place via the third-party software or the community system provider (CSP).

The haulage company must also make sure that their drivers know what documents to present at each stage of the journey, including:

- at ports or train terminals

- at customs posts

Note: Depending on your route, some or all of these documents may be submitted digitally in advance. Please ensure you understand the process for the route you are using

Driver

The driver must carry the information and documentation provided by the haulage company in the vehicle for the duration of the journey. This also includes information and documentation necessary to meet EU member state requirements. This is because each movement of goods from the EU to the UK is both an export movement for EU authorities and import movement for UK authorities, and vice versa.

It is vital that drivers know what information and documentation is needed, and where, when and how they will be presented and checked.

Section 3: Safety and security requirements – ENS and EXS declarations

Background and upcoming changes

There are 2 types of safety and security declarations: an exit summary (EXS) declaration and an entry summary (ENS) declaration.

The UK has a temporary ENS declaration waiver in place for all EU to GB movements (unless otherwise exempt).

Full UK safety and security export procedures are in place.

The Border Target Operating Model sets out future requirements for safety and security declarations.

The EU has had full ENS and EXS declaration requirements in place since 1 January 2021. Specific procedural details on a member state by member state basis are listed later in the document for:

Entry summary declaration (ENS)

For accompanied roll on roll off (RoRo) freight, the haulier (as the carrier and operator of the active means of transport) is responsible for submitting the ENS declaration – also known as the safety and security declaration – at the first point of entry.

For unaccompanied RoRo freight, the ferry operator (as the carrier and operator of the active means of transport) is responsible for submitting the ENS declaration at the first port of entry. For ports with inventory linking, the ferry operator will complete the manifest. For example, in the Netherlands, the manifest must have all the ENS date entries for that ferry, prior to it being allowed to leave the UK. The information will need to be provided before the ship departs the port.

The data required for an ENS declaration includes:

- consignor

- consignee

- a description of the goods

- routing (country by country)

- conveyance (for example, ferry or Eurotunnel details)

- time of arrival

An EORI number is required to make ENS declarations. This needs to be a:

- ‘GB’ EORI number for GB safety and security (or ‘XI’ EORI number for Northern Ireland)

- valid EU member state EORI number for EU ENS declarations

A third party may lodge a declaration as long as this is done with the knowledge of the carrier and consent. However, it remains the carrier’s responsibility to make sure that:

- an entry summary declaration is submitted

- declarations are submitted within the legal time limits

The third party must also make sure that the information given by the carrier is accurate.

An ENS is not required for goods covered by an ATA or CPD carnet (Carnet de Passages en Douane) provided the goods are not moved under transport contract.

For GB, the carrier will need to sign up for access to the S&S GB service to lodge ENS declarations. This process can also be completed by a third party with their knowledge and consent.

Find out about the GB ENS process.

Exit summary declaration (EXS)

A carrier (meaning the haulier for accompanied RoRo movements, and ferry operator for unaccompanied) is required to submit any EXS declarations to the customs authority of the country from which the consignment is being exported.

EXS data is normally included in the export declaration (which is a customs declaration). If a customs export declaration has been lodged, there is no need for a separate EXS declaration. The person normally responsible for submitting a combined declaration is the exporter of the goods, or their representative.

A standalone EXS declaration is usually required if:

- the goods have remained in temporary storage for more than 14 days

- the goods have remained in temporary storage for less than 14 days but the import safety and security declaration details are unknown or where the destination or consignee details change

- goods are moved under transit and there is no full export declaration, using either a:

- Transit Accompanying Document (TAD)

- Transit and Safety and Security Declaration (TSAD)

- Transports Internationaux Routiers (TIR) carnet document

TSADs cannot be used to meet safety and security requirements in GB.

A standalone EXS declaration is not required for any empty pallets, empty containers and empty vehicles moved out of GB, including those moved under a transport contract. An EXS declaration is also not required if the goods are covered by an ATA or CPD carnet.

For combined safety and security, customs export declarations, and for standalone safety and security EXS declarations, the submission can be made on the Customs Declaration Service (CDS) or the Customs Handling of Import and Export Freight (CHIEF) system. There is still the option to submit EXS declarations through CSP systems or third-party software providers.

Find out about the GB EXS process.

Section 4: Moving goods from GB to the EU (exporting from GB)

Customs requirements

To enter the EU, goods must satisfy customs requirements outlined in general terms in section 4a. Additionally, 3 types of movement (CTC, ATA, TIR) could alter the customs processes required.

4a. General process

If applicable, refer to these sections once you have reviewed section 4a.

4b. Common Transit Convention (CTC) movements from GB to the EU

4c. ATA Carnets movements from GB to the EU

4d. TIR Convention movements from GB to the EU

If you are transporting some commodities you will also need to consult:

4e. Additional requirements for moving specific goods into the EU

- excise goods

- animal, plant and other controlled products

- animals, animal products, plants, fish and fishery products

- marine-caught fish for human consumption

- live animals

- endangered or protected animal or plant species

Regardless of which process you use, you will need to consult and understand section 4a for general import/export requirements.

Section 4a: Moving goods from GB to the EU – general process

As of 1 January 2022, full export controls and checks are in place for movements to the EU and border locations will need processes to control goods for export.

This means that goods must be presented to customs before they reach the frontier or at the frontier.

They must not be exported without permission and a message must be sent after their departure.

Border locations can use different systems to fulfil their exports obligations, there is no specific system mandated for the export process.

Examples of systems that are commonly used are the:

- Goods Vehicle Movement Service (GVMS) – hauliers will need GVMS to link export declaration references together into one single Goods Movement Reference (GMR), the driver will present the GMR at the port or terminal of exit and the carrier will be responsible for capturing and validating the GMR at check-in

- Inventory-linked Systems – declarations will be pre-lodged by the declarants, hauliers will then move the goods to the border location where they will be arrived and presented. If any checks are required, this will take place within the border location’s approved premises

Only goods moving via specified locations, identified as having space constraints and where modified export controls apply, are able to submit an arrived declaration.

You can check locations where an export declaration needs to be submitted as arrived.

The new procedures are outlined in the exports section of the Border Operating Model.

List of ports using GVMS.

Preparing for export from GB: customs documents and procedures that hauliers need to know

The hauliers need to determine if the goods would be exported through a location using GVMS for export controls and if the port is one with limited space where arrived export declarations should be used.

Further information on the different processes can be found in the exports section of the Border Operating Model and how to export goods from the UK.

If the goods are not moving under transit, the exporter/agent/freight forwarder should provide the haulier with all customs documents for the pre-lodged import declarations for the member state the haulier is crossing the border to.

Inventory-linked ports

For inventory-linked ports, including all unaccompanied freight, the trailer operator must provide the Unique Consignment Number (UCN), provided by the exporter, in order to leave the goods at the port and have them accepted.

Note: For inventory-linked ports, the EU import detail may not yet be known. It may be that there is no information for the driver about the EU import at the time of export. The exporter/loader needs to clarify to the driver/trailer operator what the EU member state requirements are. If this information is shared digitally, the driver does not necessarily have it (or they often pick up a copy upon arrival on the EU side).

Hauliers must continue to create a goods movement reference (GMR) for empty loads or loads with multiple import or export declarations.

GVMS border locations

If exiting GB using locations using GVMS to control goods, hauliers will need to:

- ask the exporter or agent to provide the correct references for each consignment carried

- link all these references together into one GMR for each vehicle movement (inclusion of any safety and security declaration MRN is an optional extra step) – references can be linked in 2 ways:

- a direct link from the haulier’s own system into GVMS; or

- an online portal available in the haulier’s Government Gateway account

- for each vehicle, update the GMR with the correct vehicle registration number (VRN) – this can be updated to cater for any changes but must be correct when the GMR is presented to the carrier at the point of departure

- instruct drivers not to proceed to the border before all the necessary references are added into a GMR to make it complete, or if any declaration reference has not been accepted onto the GMR, as they will not be allowed to board

- instruct drivers to present the GMR to the ferry operator/Eurotunnel on arrival at the point of departure to demonstrate they have the necessary evidence to legally move goods

If exiting through an arrived export location:

- The haulier will need to enter all export declaration references (DUCRs) associated with the vehicle movement into the GMR. GVMS will validate each DUCR and confirm whether the goods have Permission to Proceed (P2P) or whether there are any outstanding controls.

- The haulier will then need to check with their declarant on what checks need to happen. Some checks can be completed at the trader’s premises, while others will require attending an Inland Border Facility or at the port’s designated customs checking facility.

- Drivers must not proceed to the point of exit until all DUCRs have P2P status and the GMRs have been validated.

- At the point of exit the driver will present the GMR to the carrier and the carrier will validate the GMR at check-in. GVMS will reject the check-in attempt unless all the DUCRs in the GMR have arrived, in which case the vehicle will be turned away from check-in.

Before you exit GB

If exiting through an arrived export location, once the declaration is submitted, the declarant will be informed if their document or goods need to be checked.

If a physical examination is required, the declarant will need to tell the haulier present the goods at the nearest Inland Border Facility for goods leaving Dover, Holyhead or Eurotunnel or the port for goods leaving Liverpool, Heysham, Milford Haven/Pembroke or Fishguard.

For accompanied RoRo freight, the driver must have all necessary reference numbers or documents to meet the import requirements of the country they are entering in the EU. It is the responsibility of the GB exporter (with their customs agent and/or logistics provider) to ensure this is done unless they have agreed another party will take responsibility for this as part of their incoterms.

You may need to submit an EXS declaration, see section 3.

At the EU border

The driver must follow the EU member states’ import and border requirements for the country they are entering. Further country-specific information for the main EU member states for RoRo freight is set out below.

Moving goods through the short straits – GB to France

France has implemented a smart border system for processing freight using both the ferry and Eurotunnel crossings. It pairs customs declaration data with the vehicle registration number transporting the consignment(s).

They have also produced substantial guidance and comms. At check-in at the Port of Dover ferry terminals or at the ‘pitstop’ at Eurotunnel’s Cheriton terminal, the driver will hand in the MRN(s) from the transit or French import declaration. The MRN will be scanned and matched with the Vehicle Registration Number (VRN) or Trailer Registration Number (TRN) – trailers are at Dover only.

Note: The process for sending data can also be done digitally on the Eurotunnel portal or via electronic data interchange (EDI). That generates a Eurotunnel Border Pass (EBP) with which the driver does not need to show any paperwork at the pitstop but can continue on this reference.

For consignments from multiple traders, either the exporter or the driver can scan all the barcodes from the separate documents, using the Enveloppe website. This will create an MRN envelope. The driver will then only need to present one single MRN from the load they are carrying.

This data is analysed by the French customs system while the driver and consignment(s) are on the ferry or shuttle train crossing the Channel. It allows HGVs or LGVs to be pre-selected for further customs and/or sanitary and phytosanitary (SPS) controls.

The driver will be informed en route – via screens on board the driver carriage at Eurotunnel or in the drivers’ lounges on the ferries if:

- they can proceed – they will be ‘green routed’

- they need to present to goods for customs and/or SPS – either ‘Orange-douane’ or ‘Orange-SIVEP’

- there are any problems that need to be addressed before they can continue their journey – they will be ‘Orange-routed’

On disembarkation of the ferry or shuttle service, if selected for a control (that is, orange routed), it is the driver’s responsibility to follow that guidance – if they ignore the routing, they could face penalties. Also, to note, that there may also be selections from green-routed trucks to check compliance.

Safety and security declarations for entry into France

For freight from GB, ENS declarations must be submitted into the French Import Control System (ICS) before crossing the EU border. Submission can only be made by EDI using certified software (or web portals).

For accompanied freight, the haulier makes the ENS declaration entry into the French ICS.

For unaccompanied freight, the ferry operator makes the ENS declaration entry into the French ICS.

Compliance regimes in France (customs and SPS)

If you are selected for a control on entry to France, either for customs or SPS or both, you must follow the orange routing signage (for either customs or SPS) to attend the facility.

If you are selected for an SPS control (SIVEP), you must seek help from a ‘commis’ service (for ferries) or Eurotunnel operatives (for Eurotunnel) to unload, load and present your consignments and to the administrations

Moving goods through Dutch ports – GB to continental Europe

The Netherlands logistics industry has advice on how to pass through Dutch ports. This will help freight and logistics operators with the various formalities involved in UK-Dutch transportation of goods. The import can only be created once the manifest is submitted to Dutch customs, a process that happens once the ferry has left GB.

If there is a transit starting from GB side the ferry line will report this to customs via Portbase.

Safety and security declarations for entry into the Netherlands

The ENS data for the safety and security declarations are submitted at the time of booking the crossing. The transmission of the ENS declaration is always completed by the carrier (that is, the ferry operator) for both accompanied and unaccompanied freight when the ferry departs via Portbase into the Netherlands ICS.

Moving goods through Belgian ports

The majority of RoRo freight via the port of Zeebrugge is currently unaccompanied. There are 5 steps. The haulier normally has a role in step 3 and step 5.

- The UK trailer operator or person booking the crossing supplies the shipping company with the ENS data at the time of booking and gives it to the shipping company.

- The Ferry Operator does the ENS declaration to customs at the same time as doing the temporary storage declaration to customs.

- The terminal operator produces a discharge notice to the importer, forwarder, customs agent or haulier.

- The customs representative does a follow-up declaration to customs.

- The terminal operator issues a cargo release to the haulier for them to pick the goods up.

The RX/Seaport digital system joins up the data submitted and required by all parties at the Port of Zeebrugge. The data is registered for imports and exports through their e-Desk. This can be done manually, through a linked data connection or through customs software.

Drivers will not be allowed to leave the terminal if discharge notice is not given and the cargo released (on arrival in Zeebrugge) nor can they proceed to the Zeebrugge Terminal if customs declarations have not been pre-notified through the RX/SeaPort e-Desk.

RX/SeaPort has detailed information about importing and exporting through the Port of Zeebrugge.

At Antwerp, the pre-notification of customs documents is done via the Port Community system of C-point. This pre-notification can be lodged by the exporter, the freight forwarder, customs agent or the haulage company.

C-point has detailed information about customs procedures at Antwerp.

Check with your ferry operator about the use of any IT platform.

Safety and security declarations for entry into Belgium

ENS declarations should be submitted into the import clearance system via an EDI interface to the Paperless Customs and Excises (PLDA) system.

In Belgium, the ENS declaration submission is done by the ferry operator or shipping company for both accompanied and unaccompanied freight.

Moving goods through Spanish ports

Hauliers going from GB to Spain should:

- make or arrange to make the ENS declaration into the Spanish ICS

- obtain the MRN

- log into the maritime carrier (Brittany Ferries) system and link the vehicle registration number to the MRN

- the system checks the first 4 digits of the Integrated Tariff of the European Communities (TARIC) code, number of packages and weight

The data must be sent to the carrier in advance of the HGV arriving at the GB port or the driver must have it with them.

Safety and security declarations for entry into Spain

An ENS declaration must be lodged for all consignments. The ferry operator must be satisfied that this requirement has been met before loading will be authorised.

For accompanied freight, the haulier makes the ENS declaration entry (using EDI only) into the Spanish ICS. This does not rule out the possibility of a private agreement between the ferry operator and the haulier for the ferry operator to make the ENS declaration for accompanied freight.

For unaccompanied freight, the ferry operator makes the ENS declaration entry into the Spanish ICS.

The ferry operator sends the manifest (including references to previous ENS declarations) to the operatives in the Spanish ports. The operatives then send the documents to Aduanas (Spanish customs).

Moving goods through Irish ports

All EU import declarations need to be submitted to the Automated Import System (AIS).

The Irish Revenue Customs RoRo Service provides 3 functions to facilitate the flow of commercial vehicles into and out of Irish ports. The 3 functions are:

- Pre-boarding notification – customs declarations should be made in advance of arrival at the port of departure in the UK. The details of safety and security and customs declarations for all goods to be carried on an HGV need to be recorded in the pre-boarding notification (PBN). The PBN is a virtual envelope that links together the details of all the goods being carried on an HGV. The customs authority will provide a single instruction to be followed by the driver on arrival at an Irish port, regardless of the number of consignments on board the vehicle.

- Channel look-up (CLU) – hauliers can track the progress of the PBN via the Customs RoRo Service so that they know when to arrive at the terminal. The CLU service provides information on whether an HGV can directly exit the port or if the goods need to be brought to customs for checking. This information will be made available via the Customs RoRo Service 30 minutes prior to arrival of the ferry into Ireland and can be accessed by anyone in the supply chain.

- Parking self-check-in – drivers whose vehicles have been called for a physical inspection will remain in their vehicle and inform Revenue that the goods are available for inspection using this function. When an examination bay becomes available the driver will receive a text message advising where to attend for inspection.

Using the Customs RoRo Service is a prerequisite to receiving the PBN without which access to the ferry will be denied.

Verification and release regimes in Ireland

If issues cannot be resolved goods will be held in temporary storage for a maximum of 90 days.

Holding areas are in place around ports but space is limited. If goods are seized, claims must be made within one month and in writing.

Traders must pay a fee to use border control posts (BCP) and an additional fee may be required if notification is not received prior to arrival.

Goods may be refused entry or destroyed if SPS requirements are not met.

Find out about bringing goods into Ireland from GB.

After the Irish border

Once the goods have passed EU customs, if they have not been selected for a control, they can proceed to their destination.

Safety and security declarations for entry into Ireland

There is a legal requirement to submit an electronic customs safety and security declaration in advance of import.

This declaration is called an entry summary (ENS) declaration. The ENS declaration must be submitted to Irish customs in advance of the goods departing GB.

The carrier is responsible for ensuring that the ENS declaration is submitted. Accordingly, the importer must ensure that the carrier of your goods is aware of their responsibilities for this declaration. Failure to do so will lead to delays.

Find out about the ENS in the Import Control System (ICS) Trader Guide (PDF, 688KB).

Section 4b: Moving goods from GB to the EU – CTC movements

Before leaving GB

If the trader decides to move the goods under the Common Transit Convention (CTC) starting in GB, the haulier will need either:

- a transit accompanying document (TAD) from the trader and a DUCR, if required, and be told by the trader that the movement has been released to the transit procedure and that they can proceed to the place of exit from GB

- a local reference number (LRN) or a TAD that has not been released to the transit procedure, and be told to present the goods and the LRN or TAD to the UK Border Force at a nominated UK Office of Departure – the goods will then be released, and a TAD will be given to the driver. The TAD will include a transit Movement Reference Number (MRN) (in the top right hand corner), which is needed when using transit to move goods

- a single vehicle may need multiple LRNs – you will need to convert all LRNs into TADs to continue your movement in a compliant manner

- an LRN will need an accompanying CDS or CHIEF entry (usually performed by your GB exporter) to be released

From 1 August 2023, if the goods are leaving from a location that needs an export declaration to be submitted as ‘arrived’, hauliers will need to follow the processes noted below:

- Link all the export declaration references (DUCRs) in a GMR, or get a Master Unique Consignment Reference (MUCR) (PDF, 103KB) from the declarant in writing. This will need to be presented by the driver at the office of departure along with the LRN.

- Make sure there are no pending documentary checks on the DUCRs. If there are any, the driver may be turned away at the office of departure.

- Take the goods to an Inland Border Facility (IBF) or a port’s designated customs facility first, if it is selected for an inspection. The driver will need to inform the staff at the site that the goods have been selected for an inspection.

- If the driver is given a MUCR by the declarant under step 1, and the goods are presented at an office of departure along with a valid MUCR and LRN, the driver will receive a printed TAD. The haulier will then need to input the transit MRN from the TAD (in the top right hand corner) into the GMR. This will need to be done before arriving at GVMS location and failure to do so will result in the goods being turned back at the frontier.

- If CTC movement has been started at an Authorised Consignor’s premises, the haulier will need to have a DUCR to include in the GMR unless the movement is in accordance with any of the following authorisations:

- Customs Supervised Export (CSE)

- Designated Export Places (DEPs)

- Internal Temporary Storage facilities (ITSFs)

- Export Memorandum of Understanding (MoU)

- Have a valid GMR for leaving through any of GVMS locations. If the driver does not have one, they will not be able to leave.

Note: check beforehand as the process can vary per port.

The exporter/agent is responsible for updating the haulage company and driver on the status of the TAD.

Safety and security requirements apply as normal in the EU and GB for goods being moved using transit.

Combined TSADs cannot be used to meet safety and security requirements in GB (UK EXS declarations). Traders moving goods under transit need to ensure that the appropriate safety and security declarations are made via other means in the EU and in GB where necessary.

As TSADs cannot currently be used for ENS requirements on transit movements from GB to EU, separate TAD entries must be made into the EU Transit System (NCTS), and separate ENS declarations must be made into that member state’s ICS using a commercial EDI platform.

At the EU border

If the movement is being made under the CTC, the TAD must be presented by the driver to the EU customs authorities in line with the EU’s procedures. In many cases, the ferry operator/Eurotunnel will do this on your behalf. Check with your carrier before you travel.

After the EU border

If the movement is made under the CTC, the driver must present the TAD at an EU Office of Destination or to an authorised consignee, where the transit procedure will be closed. The goods will then be subject to EU import procedures.

Section 4c: Moving goods from GB to the EU – ATA Carnets procedure

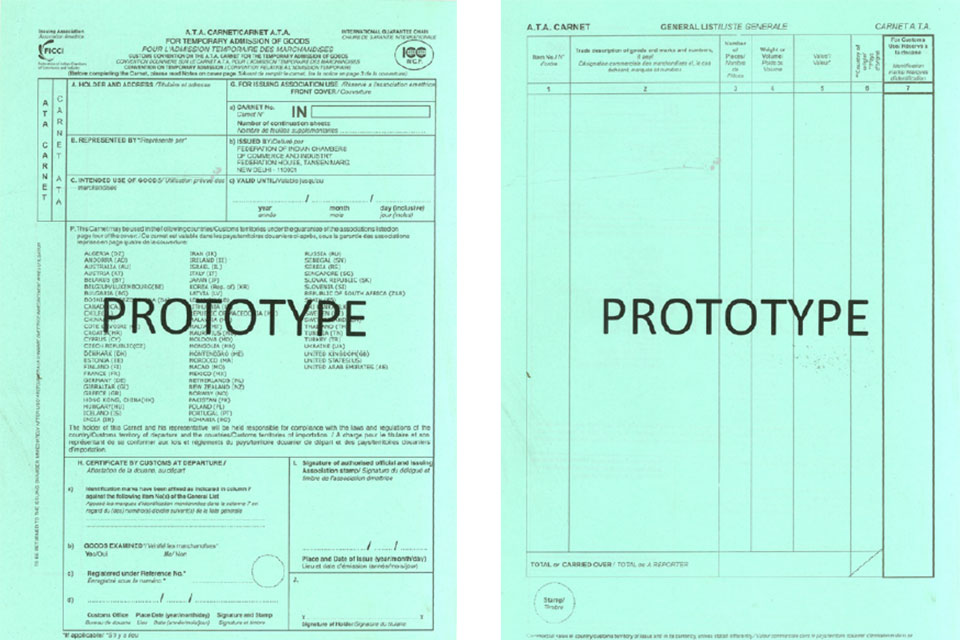

ATA Carnets are international customs documents used for the suspension of duties where goods will be re-exported within a year.

Before leaving GB

If the trader arranges for the goods to move under the ATA Convention the driver must:

- obtain the ATA Carnet document from the trader

- take the goods and the ATA Carnet to the UK Border Force at a UK Office of Departure to get the Carnet stamped

- as instructed by the trader, their agent or the logistics company controlling the movement

- check with the trader that the safety and security EXS declaration requirements have been met for the movement – relevant safety and security ENS requirements must also be met for the country the goods are being moved to

Note: Ensure that the driver of the truck is either: listed explicitly in ‘Box B’ of the Carnet, or the Carnet is accompanied by a signed authorisation letter from one of the Carnet holders, indicating their permission for the driver to move the goods and sign ‘Box F’ on their behalf.

The driver should ensure that the front cover of the Carnet has been signed and completed correctly before departure.

At the EU border

The driver must present the ATA Carnet and ensure it is stamped by the EU customs authorities in line with the EU’s procedures.

After the EU border

If the movement is made under the ATA Convention, the driver should give the ATA Carnet to the recipient of the goods when they are delivered. This is so the ATA Carnet is available to return the items to their country of origin, if not transported back by the same outbound haulage company.

Section 4d: Moving goods from GB to the EU – TIR Convention procedure

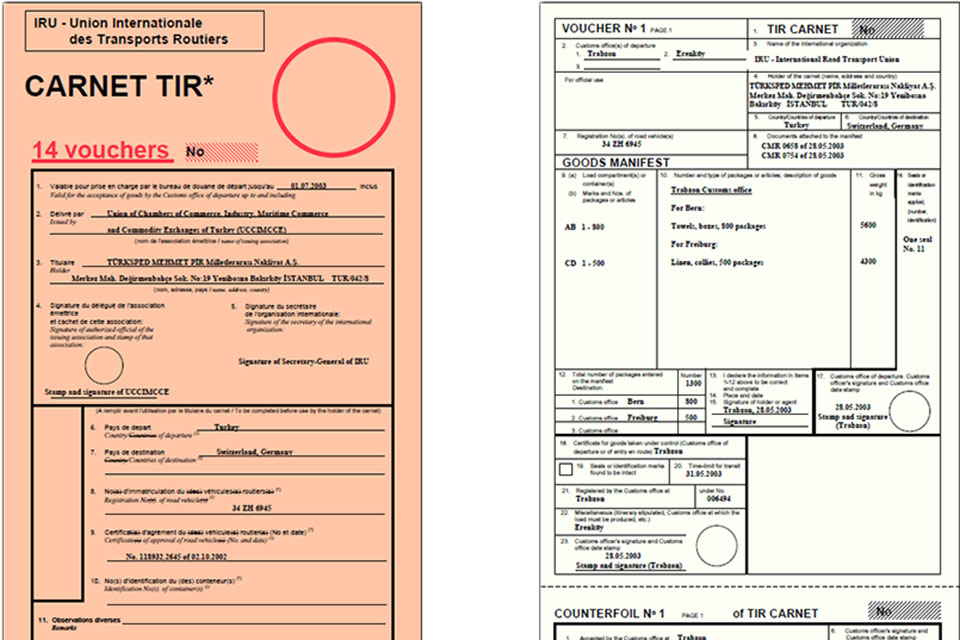

TIR Carnets are international customs documents used for the transport of goods across borders.

Before leaving GB

In order to move under the TIR Convention, the haulier must hold a TIR authorisation obtained in his/her country and the vehicle moving the goods must hold an approval certificate of a road vehicle for the transport of goods under customs seal. For exceptions from this general rule (for example, the movement of heavy and bulky goods), check the guidance for TIR.

The TIR system allows UK customs officials to pack and seal goods before they’re transported to the EU or to third countries. This means that the load will not need to be opened and inspected by customs officials at border crossings.

Book a TIR test.

The haulage company must:

- give the driver the TIR Carnet

- ensure that arrangements have been made, either by the trader or haulage company to declare the movement to NCTS once the TIR movement enters the EU and have the reference numbers (LRN and/or MRN) needed to present to EU customs authorities. Note: the part of the TIR journey undertaken in GB is not declared on NCTS, and so NCTS references will not need to be presented to UK customs authorities

- instruct the driver to:

- take and present the goods and the TIR Carnet to the UK Office of Departure where page 1 of TIR Carnet will be stamped and detached by the customs officer and customs will seal the vehicle

- take and present the goods and the TIR Carnet to the UK Border Force at a UK Office of Departure – customs will check the documents and ensure that the seal is intact, and will stamp and detach page 2 of the TIR Carnet

- note: these 2 steps occur simultaneously at the Border Force office

- check with the trader that the safety and security EXS declaration requirements have been met for the movement – relevant safety and security ENS requirements must also be met for the country the goods are being moved to (see safety and security for the procedure for submitting EXS and ENS declarations)

At the EU border

If the movement is made under the TIR Convention, the driver must present the TIR Carnet and ensure it is stamped by the EU customs authorities in line with the EU’s procedures.

After the EU border

The driver must present the TIR Carnet and ensure it is stamped by the EU customs authorities either when the goods leave the customs territory of the EU or at an EU Office of Destination or at an EU-TIR authorised consignee’s premises.

Once the vehicle has completed its journey, the driver must return the TIR Carnet to their office/manager.

Section 4e: Additional requirements for moving specific goods into the EU

Moving excise goods out of GB and into the EU

Excise goods are alcohol, tobacco or energy products.

If the goods are subject to excise duty, in addition to other commercial documents, the driver must receive from the trader one of the following:

- a copy of the electronic administrative document (eAD)

- commercial documents clearly showing the administrative reference code (ARC) for the eAD

- a paper W8 form for energy products

- a copy of the customs declaration

Moving animal, plant and other controlled products into the EU

Haulage companies and drivers who transport animal, plant, and other controlled products, need to be aware of which locations in the EU have BCPs for carrying out checks on these products.

The haulage company and driver should not start to move these types of goods until they are certain that the:

- importer or exporter has checked that the route they intend to take is appropriate

- border location they intend to use is authorised to move the goods they are carrying

- trader has given them an Export Health Certificate (EHC) or phytosanitary certificate to accompany the goods

It is important to note that several EHCs or phytosanitary certificates may be needed for a single truckload even if all goods are collected from the same site.

Moving animals, animal products, plants, fish and fishery products into the EU

Traders moving animals or animal products from GB to the EU will need to apply in advance for an EHC or phytosanitary certificate.

The trader will need to make sure the EHC is signed by an authorised person after the consignment has been inspected.

Rules vary depending on the type of product and where they are exporting them to.

Check the export rules and check that the route goes through an appropriate BCP in the country of entry for exports of:

- agri-food

- animal by-products

- animal feed and pet food

- animal semen, ova and embryos

- live animals, semen, ova and embryos: Balai Directive

- live animals

- livestock and poultry

- fish and fishery products

A phytosanitary certificate must accompany consignments of plants and plant products. A trader applies for a phytosanitary certificate from the relevant plant health authority:

- Animal and Plant Health Agency (APHA) in England and Wales

- Scottish Government in Scotland

- Forestry Commission in England, Wales and Scotland for wood, wood products and bark

The driver needs to confirm with the trader or haulage company that the EU-based import agent has told the relevant BCP about the arrival of the consignment at least 24 hours before the intended arrival.

The driver must carry a physical copy of each EHC or phytosanitary certificate for their consignment. The consignments may be checked upon arrival at the EU BCP. The driver should always check before arriving at the first EU port of arrival if a physical document is required. Failure to do so has consequences. That is, those being without the check at the first EU port of arrival the driver may be told to return to that first port of EU arrival before the load can be delivered and offloaded at destination.

Moving marine-caught fish for human consumption into the EU

In addition to an EHC, exporters of wild-caught marine fish for human consumption will need to provide additional documentation.

Exporters of most wild-caught marine fish for human consumption caught and landed by GB vessels will need to obtain a UK catch certificate for each consignment to the EU.

Exporters of most wild-caught marine fish and some shellfish for human consumption caught and landed by third countries need to supply a copy of the third country catch certificate for each consignment to the EU.

Exporters may also need other documentation such as:

- processing statements: if third-country fish has been processed in the UK – this can be applied for through the Fish Export Service

- storage documents: if the imported fish has remained in the UK for a period of time and has not undergone any operations other than loading or unloading – this can also be applied for through the Fish Export Service

Exporters will send a copy of the documents to their EU importer. The importer in the EU needs to submit these to the EU competent authority in advance of the import. Please check with the importing member state about the required notice period. This is generally at least 4 hours in advance.

Moving live animals into the EU

To transport live animals into the EU, transporters need to apply to an EU member state, where they have representation, for:

- an EU transporter authorisation

- a certificate of competence

- a vehicle approval certificate

The EU does not recognise UK-issued versions of these documents.

Transporters are not permitted to hold transporter authorisation or vehicle approval in more than one EU member state.

For further information contact APHA.

Journey logs

To transport live animals from, or through, England, Scotland or Wales into the EU transporters need to apply for 2 journey logs.

- one approved by the EU member state which is the first point of entry into the EU

- one approved by APHA

Moving endangered or protected animal or plant species, and their parts or by-products under CITES

Endangered or protected animal or plant species, and their parts or by-products, under the Convention on International Trade in Endangered Species of Wild Fauna and Flora (CITES) can only pass through designated ports.

Check the latest information on these ports and CITES permit and notification requirements.

Certain products may fall under both the categories of products of animal origin and CITES items and must therefore comply with the 2 sets of requirements.

Section 5: Moving goods from the EU to GB (importing to GB)

Customs requirements

To satisfy customs requirements, there are several ways to move goods across the border (pre-lodgement, temporary storage, CTC, ATA, TIR).

The exporter/importer (and/or their agents) will choose which one to use. This section provides details about the implications of each possible procedure for hauliers.

5a. Pre-lodgement/temporary storage

5b. Common Transit Convention (CTC) movements from the EU to GB

5c. ATA Carnets movements from the EU to GB

5d. TIR Convention movements from the EU to GB

5e. Additional requirements for moving specific goods into GB

5f. Moving goods between Ireland and Northern Ireland

Section 5a: Moving goods from the EU to GB – Pre-lodgement/temporary storage

Before leaving an EU member state

When collecting the goods, the haulier must be given all the relevant customs information or documents and other paperwork. The haulier must confirm:

- that the exporter has completed the EU export procedures

- with the importer the type of import declaration they are making and secure the right evidence to demonstrate a declaration has been made depending on the route

Island of Ireland to GB

As of 31 January 2024, full customs controls apply for goods moving directly from Ireland to GB, and for non-qualifying Northern Ireland goods moving from NI to GB through Ireland. This means that hauliers moving goods from Ireland to GB will need to follow the same processes as currently apply for moving goods from other EU countries to GB.

Goods from other EU countries

As of 1 January 2022, import controls and checks are in place and border locations have processes to control imported goods. Locations where pre-lodgement is needed use GVMS.

Temporary storage locations may also use GVMS but if a location just uses an inventory system, hauliers will need to follow commercial instructions.

The new procedures are outlined in the imports section of the Border Operating Model.

List of ports using GVMS.

If hauliers are moving goods through a location using GVMS, they will be required to:

- ask the importer to provide a unique reference – this will be an MRN for goods declared into CDS – or the reason why one is not needed, for each consignment carried

- link all these references together into one goods movement reference (GMR) for each vehicle movement. Inclusion of safety and security references is an optional extra step. References can be linked in 2 ways:

- a direct link from the haulier’s own system into GVMS; or

- an online portal available in the haulier’s Government Gateway account (if the ferry operator is submitting the ENS, the haulier will need to check how to consolidate this into one GMR)

- for each vehicle movement, update the GMR with the correct VRN – this can be updated to cater for any changes but must be correct when the GMR is presented to the carrier at the point of departure. You must enter references for all the goods being carried in the vehicle into a single GMR

- instruct drivers not to proceed to the border before all the necessary references are added into a GMR to make it complete, or if any declaration reference has not been accepted onto the GMR, as they will not be allowed to board. Drivers may also be asked by Border Force to provide a GMR with all the necessary references as evidence that are legally able to move goods

- instruct drivers to present the GMR to the carrier on arrival at the point of departure to demonstrate they have the necessary evidence to legally move goods – this can be presented through paperwork, mobile phone, tablet, etc

- instruct drivers to check whether their vehicle is cleared or not cleared before disembarking and to follow instructions on where to go if checks are required

At the EU border

The driver must have, for each consignment, the EU export declaration MRN as evidence of a customs declaration from the declarant in the EU.

For goods that are moved into GB from NI and require customs declarations, the driver must have evidence of a customs declaration from the declarant in the UK.

For goods imported at locations using GVMS, the driver must present a GMR containing the declaration reference, or the reason why one is not needed, for each consignment carried to the carrier.

Some locations that use GVMS may also operate alternative processes. If you’re moving goods through one of these locations, you should check with the carrier you’re intending to travel with about what information you need to clear customs.

Some of these processes can be done digitally.

At the UK border

UK authorities do not routinely stop vehicles on their way into the UK to check that they have the correct import customs documents.

However, UK Border Force officers may stop vehicles to carry out certain checks. When they do, they may take the vehicle offline and ask the driver to present the references (for example, GMR, CDS MRN and/or EORI) for each consignment, along with other documentation or information as required.

When goods are imported at locations where pre-lodgement is needed and are moved without sufficient evidence that a declaration has been made, the driver may be liable to a penalty. Where a GMR does not contain the relevant references or options for all the goods carried, the creator of the GMR may be liable to a penalty.

On arrival, the haulier and the driver must follow HMRC instructions about whether they need to get the goods checked or if they are able to continue their journey. They may be directed to an IBF for documentary or physical checks of their load if these checks cannot be done at the border.

This currently applies for border locations at Dover, Eurotunnel terminal at Cheriton and Holyhead (for CTC movements). The goods must be taken to an IBF directly and must be in the same condition as they were at the time of importation.

A driver can check the status of their goods themselves using the Check if you need to report for an inspection service, as long as they have access to a device that can access the internet, such as a mobile phone.

The person who created the GMR should ensure that the goods arrive at an IBF for a check and that the drivers are made aware or have the means to check if an inspection is required.

It is important that the haulier ensures that their supply chain is compliant and that drivers understand their responsibilities to take goods to an IBF, if required.

You may be liable to a penalty of up to £2,500 if you fail to follow HMRC instructions. Whenever HMRC needs to consider penalties, they will always take into account the facts and what has gone wrong, on a case-by-case basis.

There is detailed guidance available for Attending an Inland Border Facility.

Section 5b: Moving goods from the EU to GB – CTC movements

Before leaving the EU

If the exporter arranges for the goods to move under the CTC the GMR must be created and the haulier must be given either:

- A TAD from the exporter/agent, and be told by the exporter/agent that the transit movement has been started and the TAD has been activated and that they can proceed to the place of exit from the EU member state.

- An LRN or MRN that has not been released into transit must be presented to the EU member state authorities at a nominated Office of Departure in the EU member state – the goods will then be released and a TAD will be given to the driver.

The exporter/agent is responsible for updating the haulage company and driver on the status of the TAD.

When moving goods into the UK under the common transit convention at GVMS locations, ensure all transit MRNs are added to the GMR. You must not add any pre-lodged import declaration references for the same goods because this puts the movement under 2 customs regimes at the same time, which is against UK regulations.

At the EU border

If the movement is being made under the CTC, the TAD must be presented by the driver following the procedures in place at each member state.

This may be performed digitally in many cases.

For entry to the UK

Note: For safety and security requirements, see section 3.

For goods moving under the CTC, haulage companies must follow either the paper-based process or GVMS process to complete the transit movement on entry to GB. Which process applies will depend on the location the goods arrive at. An overview of locations and processes is included within the Border Operating Model.

Exporters/agents must give the haulage company all TAD MRNs which have been activated for each CTC consignment. A valid MRN proves that the driver has the right declaration to move goods under transit. The paper TAD must also always travel with the goods moving via transit.

If entering the UK at a location using the paper-based procedure, the haulier will need to report to the Office of Transit with the goods and paper TAD on arrival in the UK. Customs authorities will complete the Office of Transit process and request any necessary inspections.

If entering the UK at a location using GVMS, haulage companies must use GVMS to link all the TAD MRNs into one GMR for each trailer movement.

Note: A GMR may include non-CTC consignments (for example, CDS MRN) for trucks carrying both CTC and non-CTC goods.

The haulage company must ensure the Office of Departure processes, including any control actions, are completed and that the transit movement has started before they enter any detail into the GMR.

If they enter a TAD MRN for a movement that has not been released, GVMS could invalidate the transit declaration for the movement. The trader would need to submit a new transit declaration to restart the transit movement before the goods could be moved to the UK.

They can use GVMS in 2 ways:

- a direct link from their own system into GVMS

- the online service on GOV.UK – a Government Gateway user ID and password are required for this

For each trailer movement using GVMS, haulage companies or drivers update the GMR with the correct VRN for accompanied movements, or TRN or container reference number (CRN) for unaccompanied movements. The VRN/TRN/CRN can be updated to cater for any changes but must be correct when the GMR is presented to the carrier at the point of departure.

Drivers cannot board international ferries or Eurotunnel without a valid GMR. They must not proceed to the border:

- before all the necessary references are added into a GMR

- if any transit declaration reference has not been accepted onto the GMR

Drivers need to present the GMR to the carrier on arrival at the point of departure to show that they have the necessary evidence to legally move goods.

Drivers must comply with instructions issued by border authorities to proceed to a specific location for checks once arrived in the UK, if necessary.

Note: The GMR can only be updated using the same access as the one used to create it. You cannot ask another company to update it unless you share your own access to GVMS. This is very different to, for example, the French Envelope system, because any company can access it on the website to update it before the crossing.

After the UK border

If the movement is made under the CTC, the driver must present the TAD at the UK EU Office of Destination or to an authorised consignee, where the transit procedure will be closed. The goods will then be subject to UK import procedures or will need to be entered to another customs facilitation.

The driver must be aware of the location of their Office of Destination declared by the trader. This could be at the port of entry, an IBF or an authorised consignee location. The driver must report to the right location with the goods and the paper TAD to close the movement. Failure to do so may result in delays to the procedure being closed, and difficulty releasing the financial guarantee.

Section 5c: Moving goods from the EU to GB – ATA Carnets procedure

Before leaving the EU

If the trader arranges for the goods to move under the ATA Convention the driver must obtain the ATA Carnet document from the trader.

At the EU border

The driver must present the ATA Carnet with a letter of authorisation (if applicable) and ensure it is stamped by the EU customs authorities in line with the EU’s procedures.

At the UK border

The driver must follow the port’s local procedures for the presentation of an ATA Carnet.

Section 5d: Moving goods from the EU to GB – TIR Convention procedure

Before leaving the EU

In order for the goods to move under the Transports Internationaux Routiers (TIR) Convention, the haulier must hold a TIR authorisation obtained in their country and the vehicle moving the goods must hold an approval certificate of a road vehicle for the transport of goods under customs seal.

For exceptions from this general rule (for example, the movement of heavy and bulky goods), check the guidance for TIR.

The haulage company must:

- give the driver the TIR Carnet

- ensure that arrangements have been made, either by the trader or haulage company, to declare the movement to the NCTS and have the reference numbers (LRN and/or MRN) needed to present the goods to the EU customs authorities

- instruct the driver to take and present the goods and the TIR Carnet to the EU customs authorities at an EU Office of Departure (or the Office of Departure of a third country outside the EU)

At the EU border

The driver must present the TIR Carnet and ensure it is stamped by the EU customs authorities in line with the EU’s procedures.

At the UK border

The driver must follow the port’s local procedures for the presentation of the TIR Carnet.

The driver must present the TIR Carnet to the customs office located at the port to open the transit movement for the GB leg. Customs will check the documents, the seal, put a stamp on the relevant page of TIR Carnet and detach it.

The driver will go to the customs Office of Destination or TIR authorised consignee’s premises to ensure that the TIR Carnet is handled. After that the customs seals can be removed and goods unloaded.

It is possible that the border customs office performs both entry and destination TIR procedures.

Once the vehicle has completed its journey, the driver must return the TIR Carnet to their office/manager.

Section 5e: Additional requirements for moving specific goods into GB

Note: The processes outlined in this section are additional processes to be conducted as well as the other processes.

Moving excise goods into the UK

Goods imported at locations using GVMS

If goods are going to an excise warehouse in the UK, the driver will need to ensure that they hold either a copy of the eAD or commercial documents that clearly state the ARC, before they leave the port. Drivers should obtain these documents from their customer or an intermediary working on their behalf.

Goods in Northern Ireland (where applicable) immediately before their importation into GB

If the importer has used a simplified customs procedure that allows for the arrival of the goods to be delayed, the creation of the eAD will also be delayed until the goods have arrived. The driver must instead ensure they hold a copy of the pre-lodged customs declaration, which must include details of an excise movement guarantee, before leaving the port.

If goods are still travelling to their delivery address by the end of the next working day following import, the importer (or their agent) should supply the driver at this point with a copy of the eAD or the ARC to formalise the excise movement requirements.

Find out about importing excise goods into the UK.

Moving live animals and high-priority plants and plant products into GB

If the driver is carrying high-priority plants and plant products, live animals or goods covered by CITES the EU exporter or their agent must make sure that they provide the following documents and/or data to accompany the consignments. The driver needs to present these at check-in at the EU border:

- the original, wet signed, EHCs if one or several are needed

- the original phytosanitary certificate

- any CITES documentation required

Checks on these products are carried out at the point of destination. The Border Target Operating Model sets out a timeline for checks to move from destination to the border.

Further information is also available on:

- importing plants and plant products from the EU to Great Britain and Northern Ireland

- importing live animals and germinal products from the EU to Great Britain

Moving SPS goods into GB

The Border Target Operating Model sets out proposals for a new approach to sanitary and phytosanitary controls at the border.

It has the following 3 core elements:

- A new global risk-based approach: live animals, germinal products, products of animal origin, animal by-products, plants and plant products will be categorised as high, medium or low risk, with controls appropriately weighted against the risks posed both by the commodity and the country of origin.

- Simplified and digitised health certificates: we have introduced streamlined export health certificates for animal products and live animals and will deliver digitised export health certificates leading to more automated use of data. We will digitise phytosanitary certificates through a feature on the Import of products, animals, food and feed system (IPAFFS) called ePhyto. This change will be phased in for imports, starting with the trade partners who have the highest volume of trade with GB.

- Use trust: we will pilot schemes with industry where authorised importers of plants, plant products and some animal products may be eligible for streamlined controls. To qualify they will need to provide the enhanced assurances and evidence that they are meeting the regulatory requirements and standards. See the Accredited Trusted Trader Scheme guidance for more information on the animal product pilots.

From 30 April 2024, hauliers and drivers moving goods subject to official controls into GB from the EU and EFTA that may require an inspection at a border control post will be notified if an inspection is required via an automated messaging service. It will remain the responsibility of the person responsible for the load to notify hauliers and drivers. They should provide the contact details of their hauliers and drivers on the import notification, submitted in advance of the goods arriving at a GB port of entry, for the automated message to be sent.

Find out about delaying declarations for EU goods brought into GB.

Check if you need to make an entry summary declaration.

Section 5f: Moving goods between Ireland and Northern Ireland

Drivers moving goods between Ireland and Northern Ireland face different customs procedures compared to other UK-EU trade. Under the Windsor Framework, drivers moving goods between Ireland and Northern Ireland have no customs procedures unless the goods are transiting through Northern Ireland.

Find out more about Moving qualifying goods from Northern Ireland to the rest of the UK.

Annex A: Examples of documents

Examples of customs documents

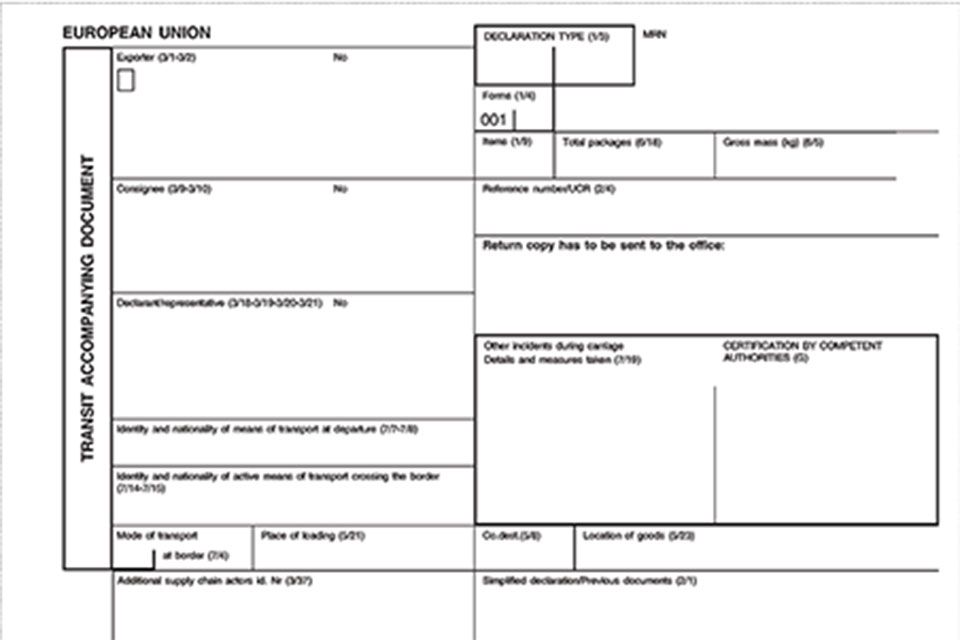

Common Transit Convention (CTC)

A TAD is required if goods are being moved via the common transit process.

ATA Carnet

TIR Carnet

Examples of certificates for specialist goods

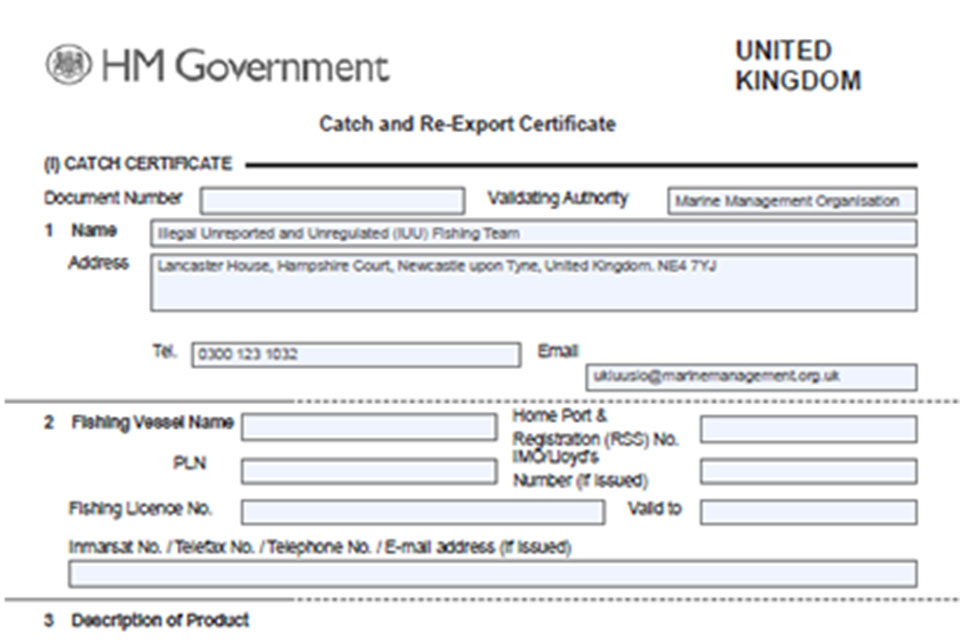

Catch certificate (for fish/seafood products)

Used for products of animal origin, fish and other seafood.

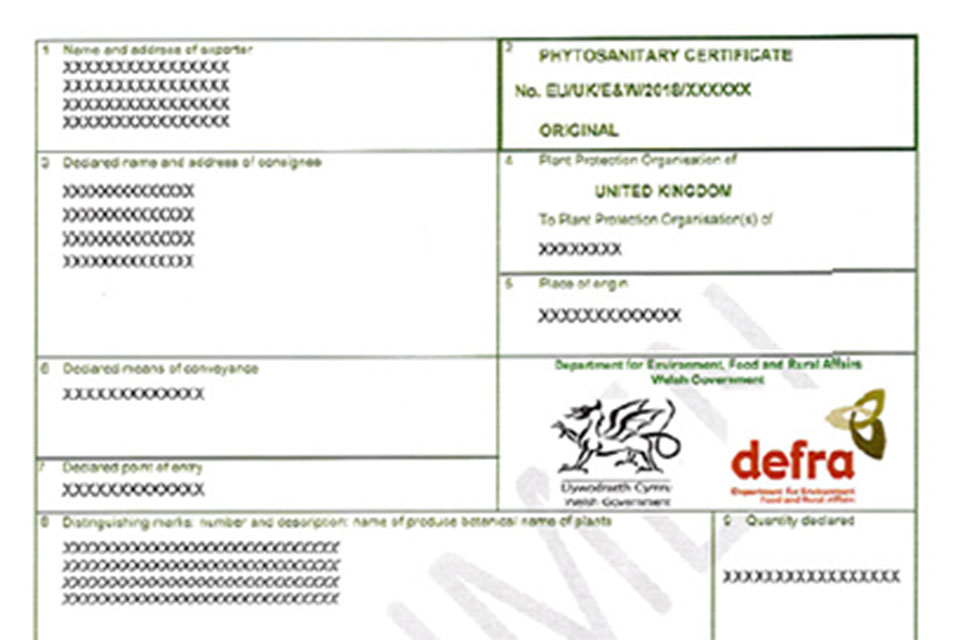

Phytosanitary certificate

Used for:

- any tree, wood, bark, soil or forest tree seed

- non-manufactured wood products in the form of packaging cases, boxes, crates, drums or pallets

- used forestry machinery

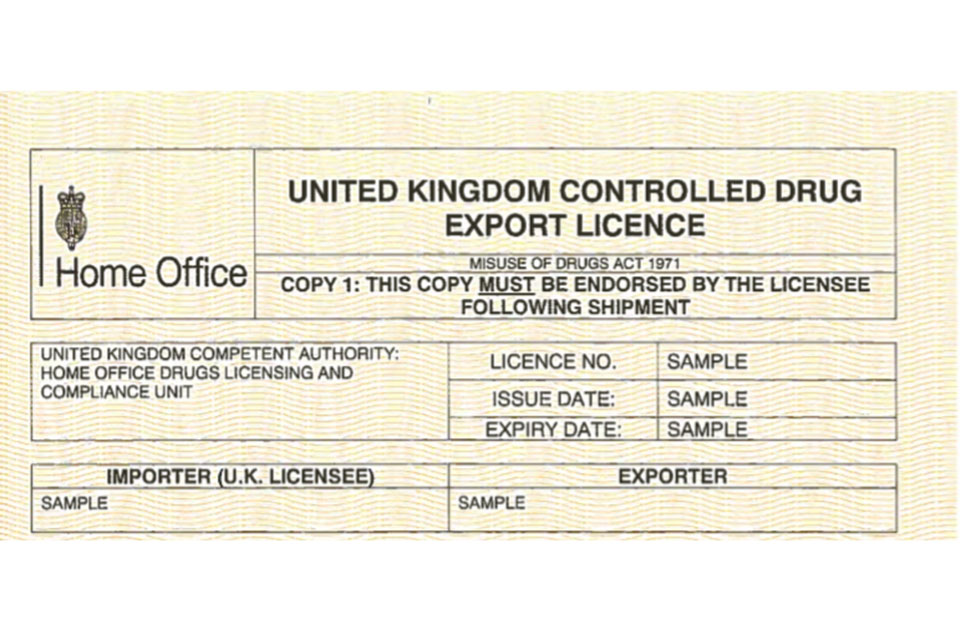

Controlled drugs licence

The document will closely resemble the document in this image.

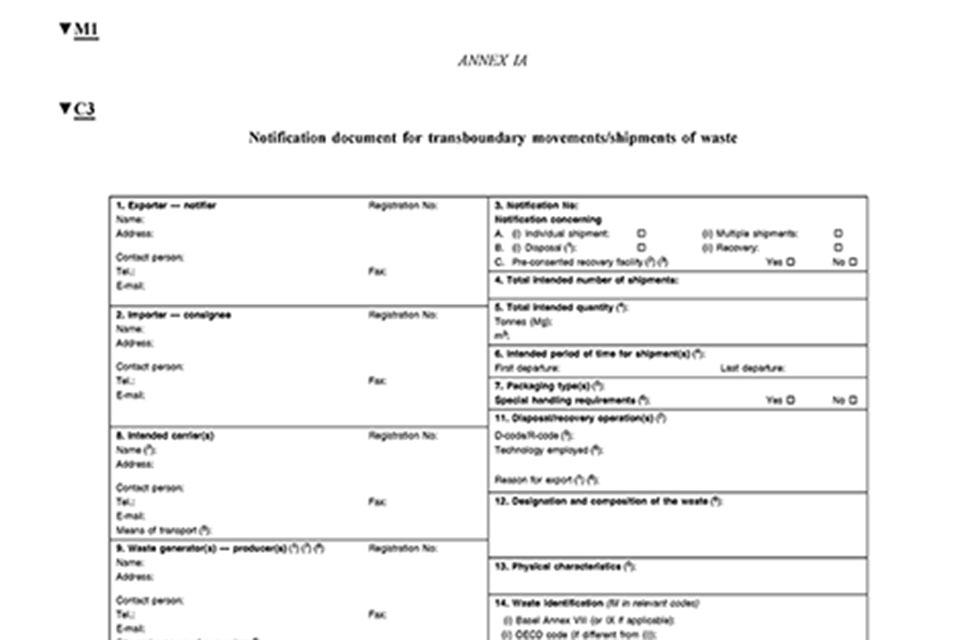

Waste export notification control document

There are different rules depending on what waste you are sending and where you are sending it.